Introduction

A car accident can happen in an instant, leaving you stressed and unsure of what to do. Knowing what to do after a car accident in Nova Scotia will help you stay calm, protect your legal rights, and simplify the insurance process.

Whether it’s a small fender bender or a serious collision, taking the right steps ensures you’re prepared to handle the situation.

In this guide, you’ll learn:

- What to do immediately after a car accident.

- The legal steps required in Nova Scotia.

- How to document the accident for insurance claims.

By following this step-by-step guide, you’ll be ready to protect yourself, minimize stress, and navigate the aftermath confidently.

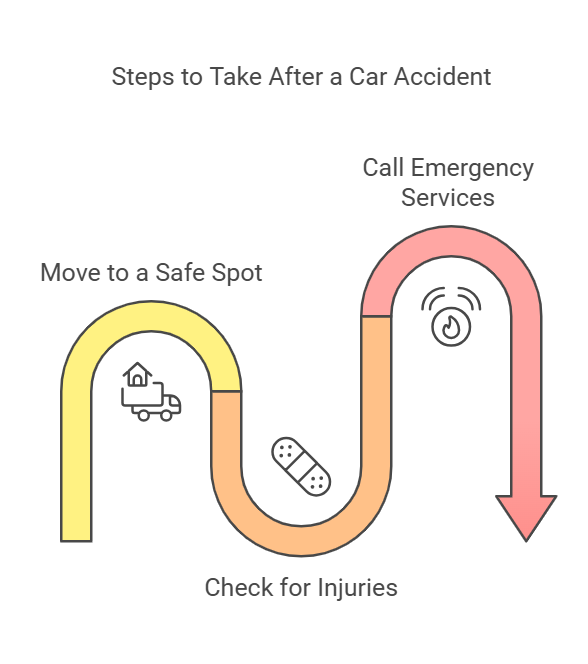

Step 1: Ensure Everyone’s Safety

Your safety and the safety of others should be your first priority. Acting quickly reduces risks and sets the stage for an organized response.

- Move to a Safe Spot

If it’s safe and the vehicle can move, pull over to the shoulder or a secure location. Turn on your hazard lights to warn other drivers. - Check for Injuries

Assess yourself, passengers, and others involved. Ask if anyone feels pain, dizziness, or discomfort—some injuries might not be immediately noticeable. - Call Emergency Services

Dial 911 if:- Someone is hurt.

- Traffic is blocked.

- There’s any risk to public safety, such as a fuel leak or debris on the road.

These steps ensure everyone is safe and emergency responders can assist as needed.

Step 2: Report the Accident to Police

In Nova Scotia, you must report a car accident under certain circumstances. Reporting creates an official record, which is essential for legal and insurance purposes.

- When to Report the Accident

Under the Nova Scotia Motor Vehicle Act, you must report the accident if:- Someone is injured.

- Property damage exceeds $2,000.

- Dangerous driving, impaired driving, or a hit-and-run is involved.

- Use Collision Reporting Centres

If police do not need to attend the scene, visit a Collision Reporting Centre to file an official report. These centres provide you with a reference number needed for insurance claims.- For details on reporting centres, visit this link.

- What to Share

Provide clear and accurate details. Avoid assigning blame or speculating about what happened. - Keep the Report Number

You’ll need this number when filing your insurance claim, so keep it safe.

This step ensures you meet legal obligations and have the required documentation for insurance claims.

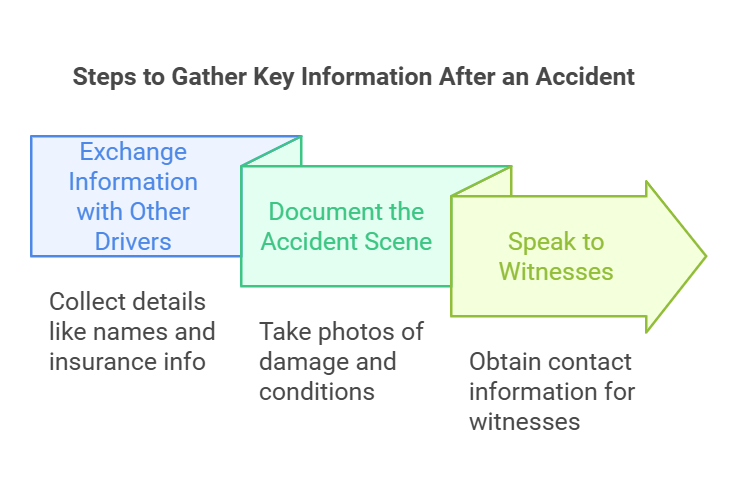

Step 3: Gather Key Information

Collecting accurate details at the scene is essential to support your insurance claim and protect yourself legally.

Exchange Information with Other Drivers

Gather the following details:

- Full names and contact information

- Driver’s licence numbers

- License plate numbers

- Insurance provider names and policy numbers

Document the Accident Scene

Use your phone to take clear photos of:

- Vehicle damage (close-ups of dents, scratches, and broken parts)

- License plates

- Road conditions, skid marks, traffic signs, and debris

- Any visible injuries

Speak to Witnesses

If anyone witnessed the accident, politely ask for their contact details. Their statements can help clarify what happened if there are disputes.

Having these details makes it easier to file your claim and ensures you’re well-prepared for any follow-up questions.

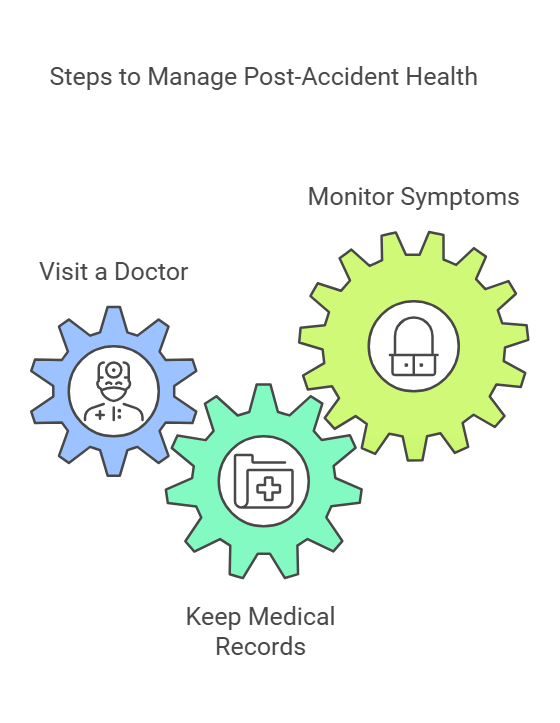

Step 4: Seek Medical Attention

Even if you feel fine, some injuries—like whiplash or concussions—may not show up immediately. Seeing a doctor is essential for your health and for documenting injuries.

- Visit a Doctor as Soon as Possible

Symptoms like dizziness, headaches, and stiffness can appear hours or days later. For example, whiplash often develops gradually and may worsen without treatment. - Keep All Medical Records

Save all records, including:- Doctor’s notes

- Treatment plans

- Prescriptions and receipts

- Monitor Delayed Symptoms

Watch for common signs of delayed injuries, such as:- Neck or back pain

- Fatigue or dizziness

- Headaches

If any symptoms appear, follow up with your doctor right away. Prompt medical care protects your health and supports any future injury claims.

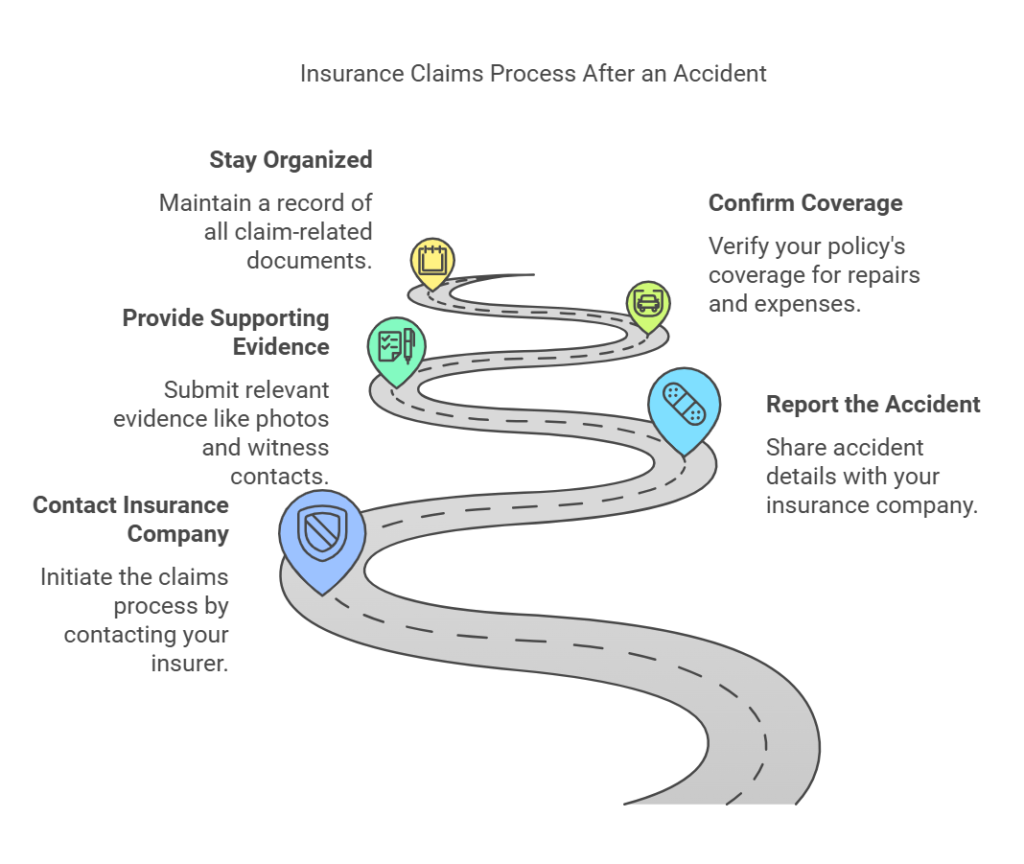

Step 5: Notify Your Insurance Company

Contacting your insurance company right away ensures the claims process starts smoothly. Delays can complicate or slow down your claim.

Report the Accident

Share the accident details with your insurer. Most companies have 24/7 phone lines or online claim portals.

Provide Supporting Evidence

Include all relevant information, such as:

- Photos of the accident scene

- Witness contact details

- The police report or collision centre reference number

Confirm Your Coverage

Ask about your policy’s coverage for:

- Vehicle repairs

- Medical expenses

- Rental cars during repairs

Stay Organized

Keep a record of your claim number, adjuster updates, and any paperwork. Staying organized ensures a smoother process.

Step 6: Understand Your Legal Rights

Knowing your legal rights in Nova Scotia helps you navigate the recovery process with confidence.

- No-Fault Insurance

Nova Scotia uses a no-fault insurance system, meaning your insurer will cover medical costs and repairs, regardless of who is at fault. - When to Consult a Lawyer

If you’re dealing with:- Significant injuries

- Disputes about fault

- Compensation that feels insufficient

A personal injury lawyer can protect your rights and ensure you receive fair compensation.

Step 7: Arrange Vehicle Repairs or Replacement

Once your claim is filed, focus on getting your vehicle repaired or replaced.

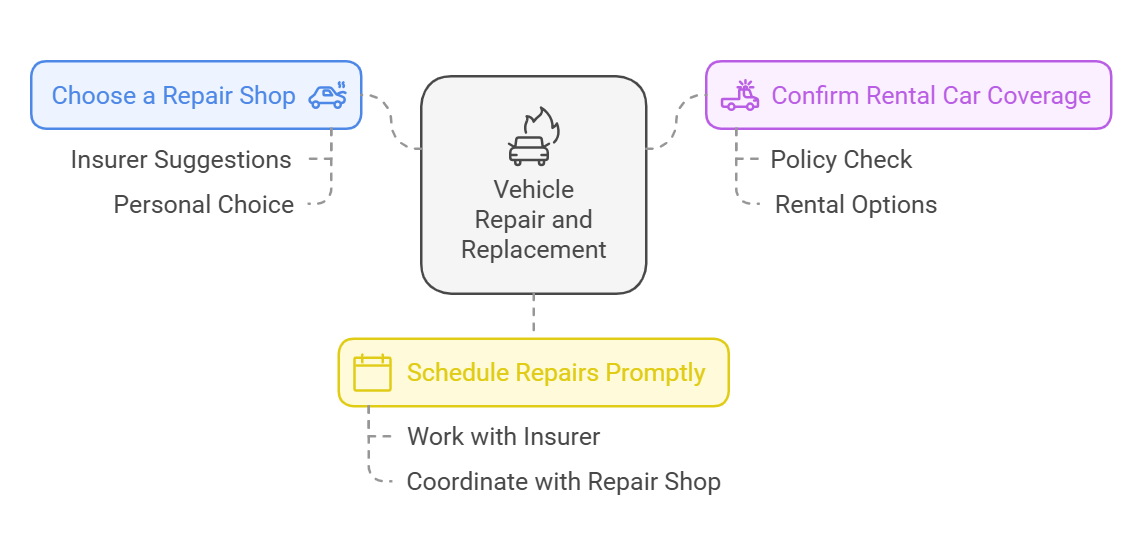

- Choose a Repair Shop

Your insurer may suggest repair shops, but you can choose any licensed mechanic you trust. - Confirm Rental Car Coverage

Check if your policy covers a rental car while repairs are being done. - Schedule Repairs Promptly

Work with your insurer and the repair shop to complete repairs quickly and safely.

Addressing repairs without delay reduces inconvenience and ensures your car is ready to drive again.

Step 8: Reflect and Stay Prepared

Once the accident is resolved, take steps to be ready for future emergencies.

- Review Your Coverage

Speak with your insurer to ensure your policy meets your needs. - Add Safety Tools

Consider installing a dashcam for added protection in case of future accidents. - Keep an Emergency Kit

Stock your car with essentials, such as:- A flashlight

- First-aid supplies

- Water and a phone charger

Taking these steps ensures you’re prepared for the unexpected.

Conclusion

By knowing what to do after a car accident in Nova Scotia, you can handle the situation with calm and confidence. Taking the right steps—like prioritizing safety, reporting the accident, and documenting the scene—will protect your health, legal rights, and financial well-being.

What you do after the accident is just as important. Small actions, like gathering evidence, seeing a doctor promptly, and notifying your insurance provider, make a big difference when it comes to resolving claims smoothly and recovering fully.

Here’s a quick reminder of a few key tips:

- Always prioritize safety and call emergency services if needed.

- Document the scene with photos, witness details, and a police report.

- Seek medical attention even if you feel fine—some injuries take time to appear.

These simple steps can protect you in the long run and make the recovery process easier.

Need expert guidance after a car accident?

Whether you’re dealing with insurance claims, disputes about fault, or significant injuries, having the right legal support can make all the difference.

Book a free consultation today with the experienced team at Laviolette Law.

Learn more about how a car accident lawyer in Bedford can help you navigate the next steps and secure the compensation you deserve.

Don’t leave anything to chance—take action now to protect your future.

[Schedule Your Free Consultation]Frequently Asked Questions (FAQs)

1. Should I inform my insurance company even if the accident is minor?

Yes, you should inform your insurance company even if the accident seems minor. Small damages can sometimes lead to hidden issues that require costly repairs later. Not reporting the accident promptly may result in your insurer denying future claims or cancelling your coverage for failing to comply with your policy terms.

2. What happens if the other driver refuses to share their information?

If the other driver refuses to provide their details, stay calm and avoid confrontation. Note their license plate number, vehicle description, and any relevant details. Immediately contact the police or visit a Collision Reporting Centre to file an official report. Authorities will follow up to obtain the information you need for your insurance claim.

3. How long do I have to report a car accident in Nova Scotia?

You are required to report a car accident as soon as possible. If police are not called to the scene, you should visit a Collision Reporting Centre within 24 hours. Delaying a report can lead to complications with insurance claims and may result in fines or legal penalties.

4. Will my insurance rates increase after a car accident?

Whether your insurance rates increase depends on the circumstances of the accident. If you are deemed at fault, your premiums may rise. However, if you are not at fault and provide proper documentation, such as a police report and evidence, it is less likely that your rates will increase. Some insurers also offer accident forgiveness for first-time at-fault accidents.

5. What should I do if my vehicle is unsafe to drive after the accident?

If your vehicle is unsafe to drive, call a tow truck to move it to a repair shop or a secure location. Check with your insurance provider to see if towing expenses are covered under your policy. Make sure to remove any valuables from the car before it is towed, and provide the towing company with your contact information.

6. How can I prove I wasn’t at fault for the accident?

To prove you were not at fault, gather as much evidence as possible at the scene. This includes:

- Clear photos of the vehicle damage, road conditions, and traffic signs.

- Witness statements and contact information.

- A police or Collision Reporting Centre report.

Dashcam footage, if available, can also provide valuable evidence. Share all documentation with your insurance provider to help determine fault.

7. Should I call a lawyer after every car accident?

You don’t need a lawyer for every car accident, especially minor ones with no disputes. However, you should consider consulting a lawyer if:

- You’ve sustained significant injuries.

- There’s a dispute about fault.

- The compensation offered by your insurance company seems unfair or insufficient.

A personal injury lawyer can provide legal advice and help you navigate claims or disputes.

8. Can I file an insurance claim if I was partially at fault?

Yes, you can still file an insurance claim even if you were partially at fault for the accident. Nova Scotia’s no-fault insurance system ensures that your insurer will cover medical expenses and vehicle repairs regardless of fault. However, fault determination may affect compensation for certain damages, like deductibles or liability claims.

9. What should I do if I hit an animal on the road in Nova Scotia?

If you hit a large animal, such as a deer or moose, pull over to a safe spot and turn on your hazard lights. Call 911 to report the incident, especially if the animal is on the road and poses a danger to other drivers. Document the damage to your vehicle and contact your insurance provider to file a claim. Most policies cover collisions involving animals under comprehensive coverage.

10. What items should I keep in my car in case of an accident?

It’s always a good idea to keep an emergency kit in your car for unexpected accidents. Essentials include:

- A flashlight

- A first-aid kit

- Bottled water

- A phone charger

- Reflective triangles or road flares

- A notepad and pen for taking down details

- Your insurance and vehicle registration documents

Being prepared can help you handle an accident more efficiently and keep yourself safe.